Gold Whale Empire — Documentation

Complete Technical Documentation — v1.0

Gold Whale Empire is a professional-grade Expert Advisor built exclusively for XAUUSD (Gold) on the M15 timeframe. It employs a 12-layer signal filtering system, intelligent position management with partial closes, dynamic trailing stops, and a daily profit target mechanism.

Developed and tested over a full year (January 2025 – January 2026) on a $2,000 account, Gold Whale Empire offers four distinct risk profiles to match every trading style—from ultra-conservative capital preservation to aggressive growth.

MagicNumber: 3690369 — Used to identify the EA's trades. Do not change unless running multiple instances.

System Requirements

Installation Guide

In MetaTrader 5, go to the Market tab at the bottom of the terminal (or click Tools → Market from the top menu).

In the Market search bar, type "Gold Whale Empire" and press Enter. You'll find it listed under Expert Advisors.

Click on the EA, then click the Buy button. After completing the payment through your MQL5.com account, the EA will be downloaded and installed automatically in your terminal.

In the Navigator panel (left side), expand Expert Advisors → Market. You should see "Gold Whale Empire" listed and ready to use.

Open a XAUUSD M15 chart, then drag "Gold Whale Empire" from the Navigator onto the chart.

In the dialog, go to Common tab and check "Allow Algo Trading". Also make sure the Algo Trading button on the MT5 toolbar is enabled. DLL imports are NOT required.

Switch to the Inputs tab, set your preferred Risk Profile, and click OK. The dashboard should appear on your chart.

Input Parameters

General Settings

▼Risk Management

▼Lot Control

▼Partial Closes

▼Profit & Protection

▼Trading Hours

▼News Filter

▼Technical Indicators

▼Advanced Settings

▼Risk Profiles

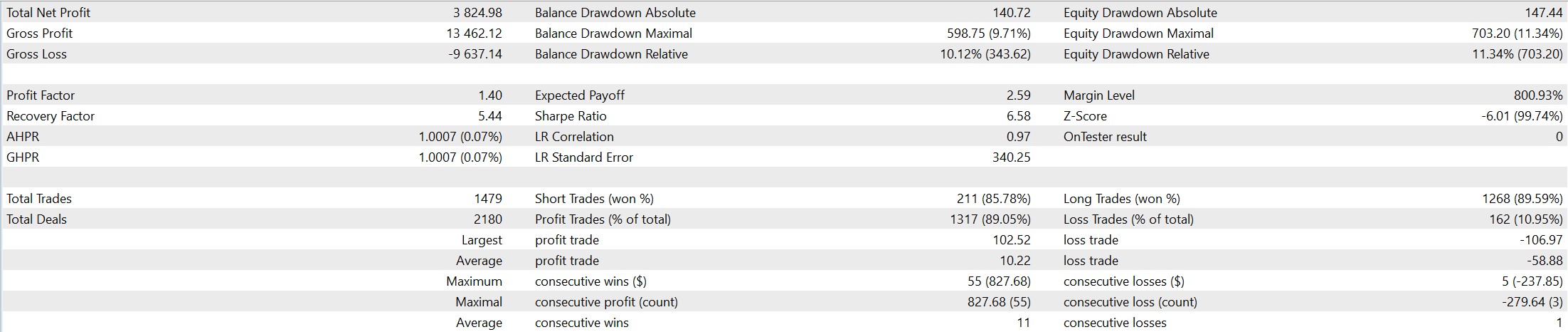

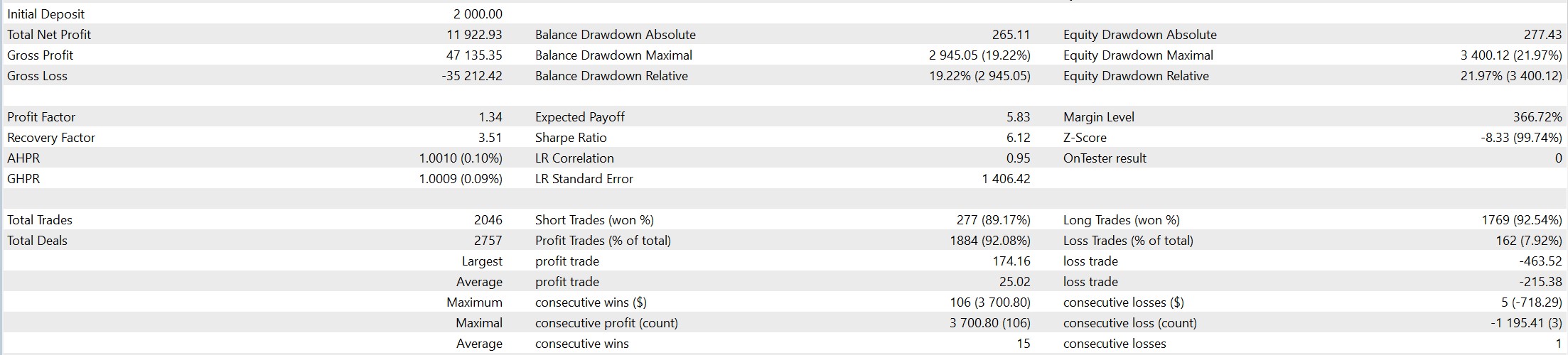

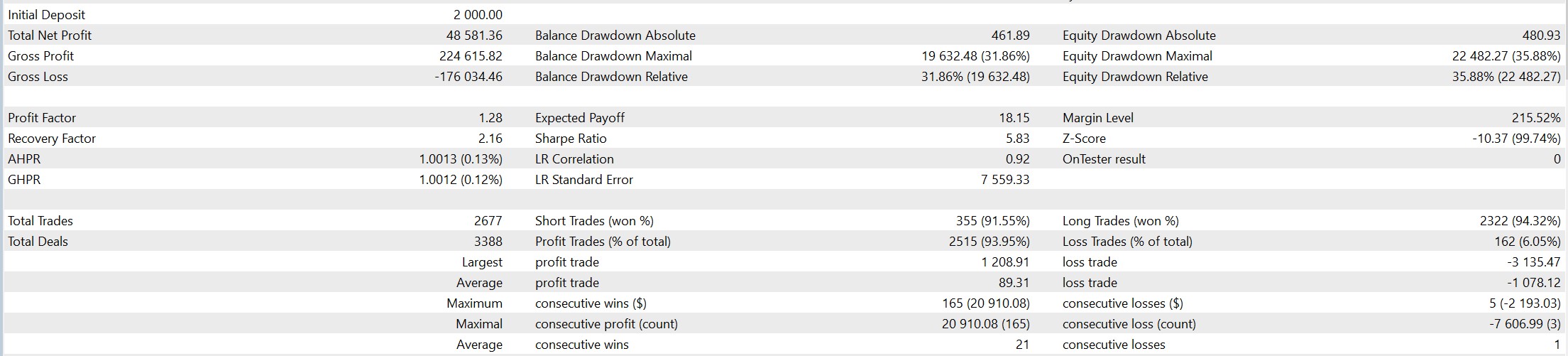

All figures below are from testing on XAUUSD M15, January 2025 – January 2026, starting with $2,000 capital.

| Metric | Safe | Balanced | Aggressive |

|---|---|---|---|

| Net Profit | $3,825 (+191%) | $11,923 (+596%) | $48,581 (+2,429%) |

| Profit Factor | 1.40 | 1.34 | 1.28 |

| Win Rate | 89.05% | 92.08% | 93.95% |

| Max Drawdown | 9.71% | 19.22% | 31.86% |

| Sharpe Ratio | 6.58 | 6.12 | 5.83 |

| Total Trades | 1,479 | 2,046 | 2,677 |

| Recommended For | Steady growth | Active traders | Experienced traders |

Tester Results by Profile

Safe Profile — $2,000 starting capital, Jan 2025 – Jan 2026

Balanced Profile — $2,000 starting capital, Jan 2025 – Jan 2026

Aggressive Profile — $2,000 starting capital, Jan 2025 – Jan 2026

Trading Logic

12-Layer Signal Filtering

Every potential trade passes through a proprietary 12-layer signal filter that combines multiple technical dimensions:

Trend Analysis — Multi-timeframe trend alignment ensures trades follow the dominant market direction.

Momentum Measurement — Momentum oscillators confirm the strength and sustainability of price moves.

Volatility Assessment — Volatility filters prevent entries during abnormally quiet or chaotic conditions.

Session Context — Time-based filters restrict trading to periods of historically higher gold liquidity.

DXY Correlation — USD Index analysis leverages the inverse gold-dollar relationship.

Each layer contributes to a composite Signal Score. The EA internally evaluates all layers and only triggers a trade when the combined analysis meets the required conditions.

Entry Logic

The EA continuously analyzes market conditions on every M15 bar close. When all signal layers and active filters agree, a market order is placed with calculated lot size, stop loss, and take profit levels. Lot sizing is determined dynamically based on the selected risk profile and current account equity.

Intelligent Exit System

Partial Close: When a trade reaches the TP progress to trigger percentage of its take profit (default 15%), the EA closes a portion of the position (default 25%). This locks in profit while leaving the remainder to run. Subsequent partial closes happen at every additional 15% of TP progress, closing 25% of the remaining volume each time.

Intelligent Trailing Stop: After the first partial close, a dynamic trailing stop activates with a configurable margin (default 10% of TP distance). The trailing stop ratchets up as price moves favorably, protecting accumulated gains without exiting prematurely on normal retracements.

Daily Profit Target: The EA monitors cumulative daily profit across all open positions. When total profit reaches the configured percentage of account balance (default 9%), ALL positions are closed simultaneously. This mechanism protects exceptional days from giving back gains.

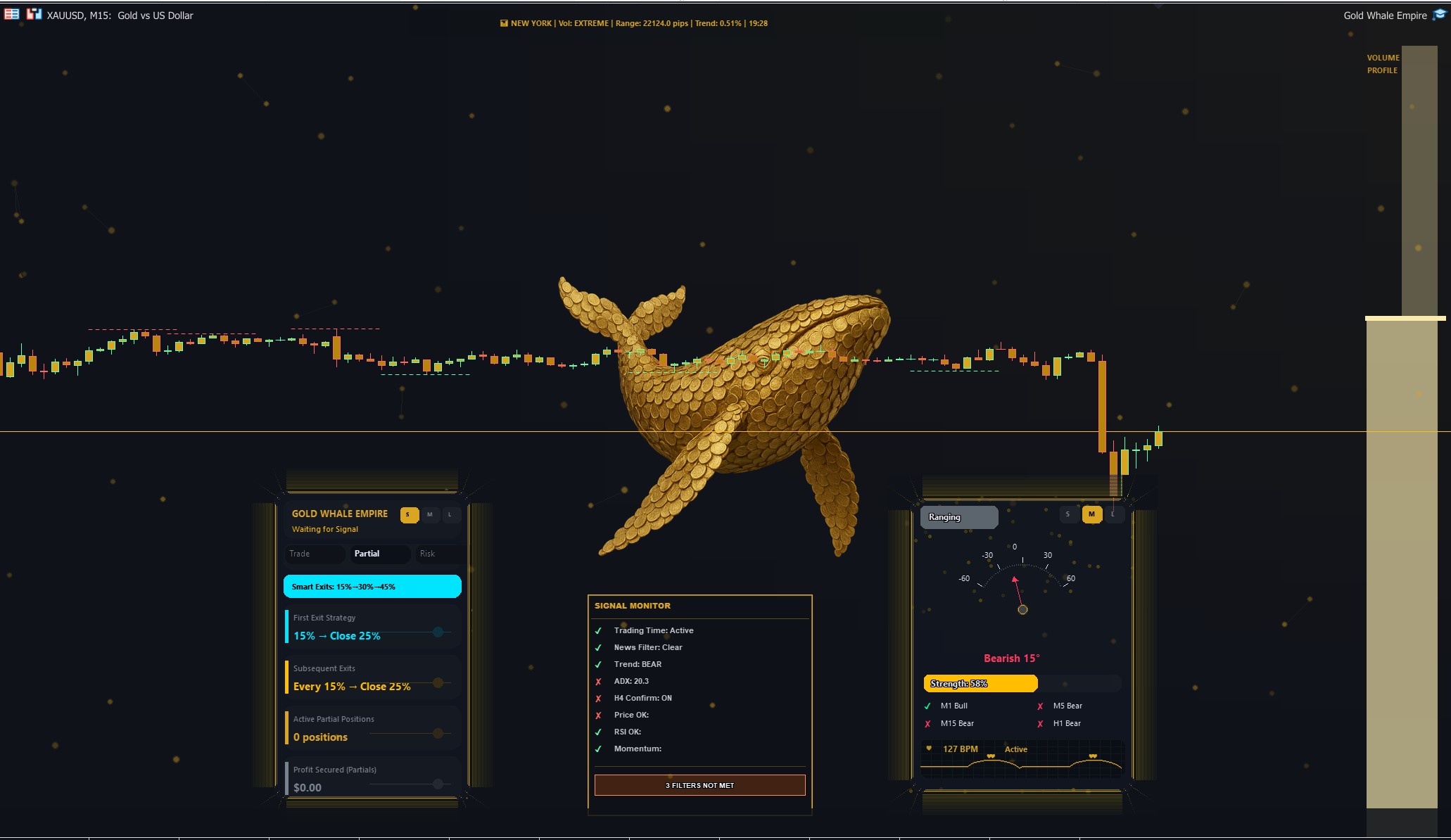

Intelligent Exit System: partial close panel showing progressive profit locking

Position Management

Every open position is evaluated on every tick. The EA tracks partial close status per trade and automatically recovers state after partial close operations. Stop losses are present on every trade from entry—the EA never holds unprotected positions.

Visual Components

Gold Whale Empire includes 8 custom visual components that transform your chart into a professional trading cockpit.

Neon Panel

The main dashboard displaying account balance, equity, daily profit/loss, active trade count, signal strength meter, and current risk profile. Updated in real-time on every tick.

Trend Compass

A circular compass indicator showing the current trend direction and strength. Green shading indicates bullish conditions; red indicates bearish. The needle rotates based on multi-timeframe trend analysis.

Gold Candle Skin

Custom candle rendering with gold-themed coloring. Bullish candles glow gold; bearish candles appear in deep blue. Makes chart reading intuitive at a glance.

Particle Field

Ambient floating particles whose density and speed reflect current market volatility. More particles and faster movement indicate higher volatility conditions.

Signal Monitor

Live signal analysis panel showing the current signal status, individual layer activity, and the last signal direction. Helps you understand why the EA is or isn't trading.

Session Info Ticker (Top Scrolling Text)

The scrolling text at the top of the chart. Displays the currently active trading session (London, New York, Asian), time until next session opens/closes, and session overlap status.

Market Ticker (Bottom Scrolling Text)

The scrolling text at the bottom of the chart. Shows real-time market data including DXY movement, XAUUSD spread, and other relevant correlated instruments.

Whale Watermark

A subtle, semi-transparent Gold Whale Empire branding watermark. Positioned to not interfere with chart analysis. Purely cosmetic.

Risk Panel and Signal Monitor displaying real-time trading data on chart

Strategy Tester Guide

Running a Test

Interpreting Results

Perfect Curves Do Not Exist

There is no EA in the real market that wins absolutely every single month. This does not exist. If someone shows you a perfectly smooth upward curve with zero losing months, it is either fake, overfitted to historical data, or uses dangerous strategies like martingale or grid that will eventually destroy the account.

Gold Whale Empire is a realistic EA. It is perfectly normal to see months with controlled losses depending on your chosen risk profile, followed by months with excellent profits. This is how real trading works.

What Matters Is the Yearly Balance

Losses will always exist — that is an unavoidable part of trading. What truly matters is the overall result at the end of the year. The general balance, not any individual month, is what defines success.

GWE is designed to navigate the markets safely even during bad months. It accepts losses, manages them with strict stop losses on every trade, and uses intelligent partial closes to lock in profits progressively. The combination of disciplined capital management and partial close exits is what produces excellent yearly returns.

A Safe & Honest Approach

Gold Whale Empire does not use martingale, grid, averaging down, or any strategy that can blow up an account. Every trade has a stop loss from the moment it opens. Risk is always controlled.

If you chase perfect curves, sooner or later you will realize they don't exist in real trading. GWE gives you something better: a realistic, sustainable system that protects your capital in bad times and delivers excellent profitability over time.

Key Metrics to Evaluate

Profit Factor > 1.0 = profitable system. The higher, the better. Our profiles range from 1.28 to 1.40.

Max Drawdown = largest peak-to-trough decline. Lower is safer. Safe keeps this under 20%.

Sharpe Ratio > 2.0 = excellent risk-adjusted returns. All our profiles exceed 5.0.

Win Rate = percentage of profitable trades. Ranges from 89% (Safe) to 94% (Aggressive).

Troubleshooting

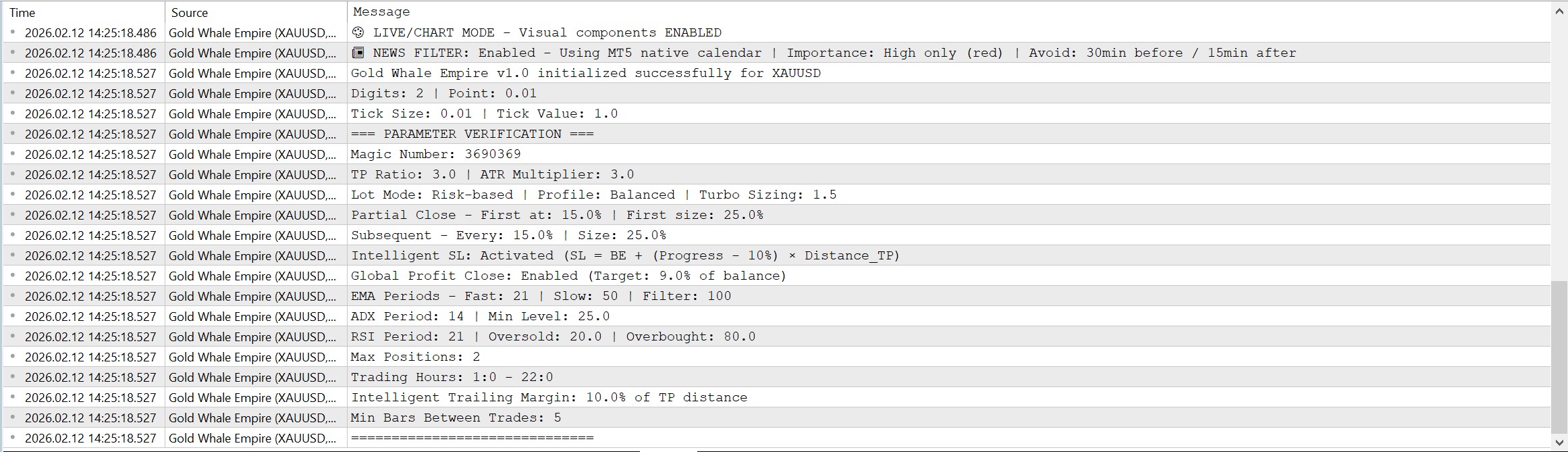

Using the Experts Tab

The Experts tab in MetaTrader 5 is your best friend for troubleshooting. Gold Whale Empire logs detailed information about its initialization, parameter verification, and trading decisions there.

The Experts tab displays EA initialization logs and parameter verification